Prudent Practices®

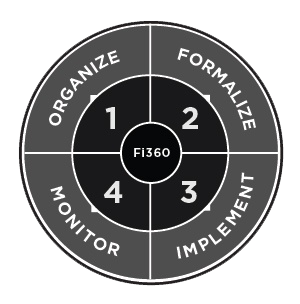

Everything we do as a company is rooted in our Prudent Practices®. Officially published in 2003, the Prudent Practices comprise a step-by-step process that ensures a fiduciary investment strategy is properly developed, implemented and monitored according to both legal and ethical obligations.

Each practice has been substantiated by applicable legislation, regulation and/or case law to ensure compliance. Full citations, as well as detailed criteria, narrative discussion, practical application and suggested procedures can be found in the Prudent Practices® handbooks.

Who is a fiduciary?

Fi360 defines an investment fiduciary as someone who is providing investment advice or managing the assets of another person and stands in a special relationship of trust, confidence and/or legal responsibility.

Investment fiduciaries can be divided generally into three groups: Investment Stewards, Investment Advisors, and Investment Managers.

An Investment Steward is a person who has the legal responsibility for managing investment decisions, including plan sponsors, trustees and investment committee members.

An Investment Advisor is a professional who is responsible for providing investment advice and/or managing investment decisions. Investment Advisors include wealth managers, financial advisors, trust officers, financial consultants, investment consultants, financial planners and fiduciary advisers.

An Investment Manager is a professional who has discretion to select specific securities for separate accounts, mutual and exchange-traded funds, commingled trusts and unit trusts.

Prudent Practices® Handbooks

Fi360 wrote the book on fiduciary best practices. Each of the Prudent Practices® Handbooks has been written by fiduciary subject matter experts to include the steps, practices, criteria and commentary. The handbooks are backed by legal substantiation based on statutes, case law, regulations and regulatory guidance.

Check out What We Do to learn all the ways we enable fiduciaries to implement a prudent process!

Advisors can leverage our online Advisor SAFE15 tool to quickly and easily assess adherence to the fiduciary standard of care for investment advisors.