5 Factors To Consider Before Adding Newer Investments To Fiduciary Accounts

Posted by John Faustino, Chief Product & Strategy Officer on September 08, 2017

While the three-year history is used as a gating factor for evaluating many investments, there may be instances where it’s prudent to select newer investments for fiduciary accounts. Waiting for three-years of history should not be a hard rule, but rather a guiding principle for evaluating investments with readily available characteristics. Here are five factors that should be considered in determining whether a new investment warrants consideration for a fiduciary account.

Answers To Your 'The HSA Opportunity for Retirement Advisors' Questions

Posted by on August 31, 2017

Earlier this week, we presented a webinar on The HSA Opportunity for Retirement Advisors. We received more questions during the webinar than we were able to answer during our 60 minutes. Here are your answers.

Raising the Bar with the Fi360 Fiduciary Score

Posted by Robin Green on August 18, 2017

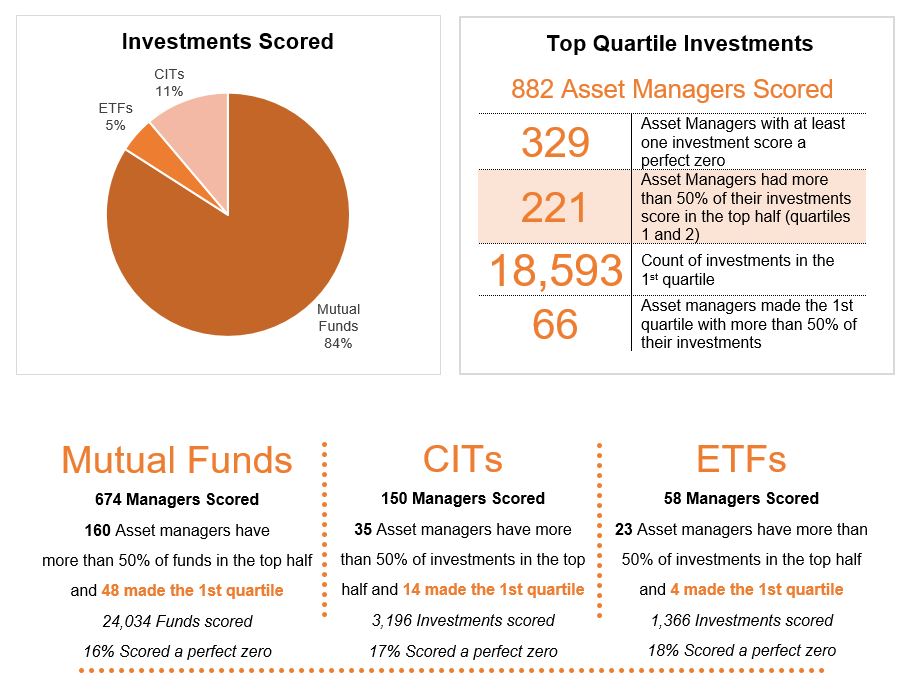

See how fund families rank! The Fi360 Fiduciary Score® is a peer percentile ranking. It evaluates investments across a spectrum of nine quantitative data points to determine if the investment meets a minimum fiduciary standard of care.

Are annual investment reviews enough?

Posted by Dave Palascak, AIF®, CFA on August 17, 2017

Errors of omission within the fiduciary process (not doing what is prudent or prescribed) are more common than errors of commission (doing something that is prohibited by law, regulation, or governing documents). Establishing and following clear, concise and practical policies and procedures for monitoring reduce compliance risks and help ensure that clients’ best interests are served.

Fi360 Fiduciary Talk 51: Regulatory Interplay

Posted by on July 17, 2017

The DOL struck first in redefining what it means to be a fiduciary today.

About

Updated weekly

Have an idea for the Fi360 blog?

Send us your question or comment

to blog@fi360.com